Learn How Payday Loans Can support You in Urgent Situations

Wiki Article

Recognizing Cash Advance: How to Be Eligible and the Benefits of Obtaining Finances

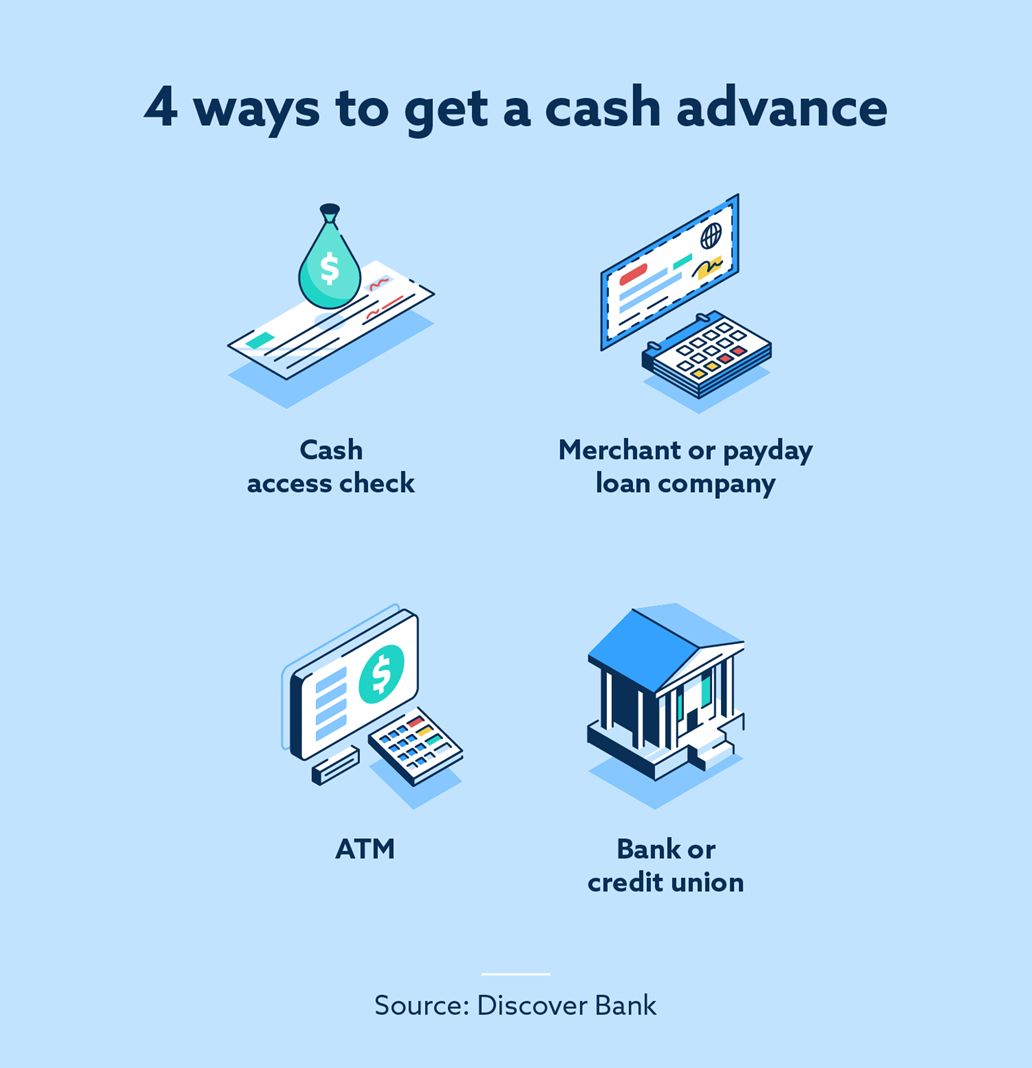

Payday advance are an economic tool that can provide quick money services in times of requirement. To certify, people should satisfy particular qualification requirements, including age and income verification. Understanding the benefits of these finances is crucial for those dealing with unanticipated costs. However, they also come with possible risks that debtors should think about. Exploring these aspects can reveal whether payday advance are a suitable option for economic relief in difficult circumstances.What Is a Cash advance?

A cash advance lending is a temporary monetary service created to supply quick cash money to individuals dealing with unanticipated expenditures. Generally, these loans are indicated to link the gap between paychecks, making it possible for customers to cover immediate expenses such as medical expenses or vehicle fixings. The application procedure is generally uncomplicated and can commonly be completed online or in person, calling for very little paperwork.Payday finances are characterized by their high rates of interest and short repayment periods, usually due within a couple of weeks. Customers commonly obtain a round figure that they need to settle with rate of interest on their next cash advance. This sort of financing is appealing for its rate and access, specifically for those that do not have conventional credit score alternatives. Nonetheless, borrowers must know the capacity for a debt cycle, as the high expense of borrowing may cause troubles in settlement. Recognizing the ramifications is crucial prior to proceeding with a cash advance.

Qualification Requirements for Cash Advance Loans

To get a payday advance, candidates must fulfill particular qualification needs, including age and residency requirements. Typically, lenders require consumers to be at the very least 18 years old and a homeowner of the state where they are applying. Additionally, a revenue confirmation process is vital to guarantee that candidates can pay off the loan as agreed.Age and Residency Standard

While certain needs might differ by residency, age and lending institution are fundamental requirements for receiving payday advance loan. A lot of loan providers need candidates to be at least 18 years of ages, as this is the adultness to participate in a contract in lots of regions. Furthermore, individuals have to give proof of residency within the state where they are obtaining the financing. This is essential, as payday advance loan guidelines can vary considerably from one state to one more. Lenders normally verify residency via records such as energy bills or lease contracts. Satisfying these standards is important for possible customers, as failing to satisfy age or residency needs may cause incompetency from acquiring the desired car loan.Revenue Confirmation Refine

Lenders' examination of income verification plays a vital role in figuring out eligibility for cash advance lendings. To certify, applicants have to offer proof of a secure income, usually via current pay stubs, financial institution statements, or tax obligation papers. This confirmation procedure guarantees that borrowers have the financial capacity to pay back the funding within the specified duration. In addition, loan providers may require a minimum revenue limit, which differs by state and lending organization. Self-employed people could require to send earnings and loss declarations to demonstrate regular revenues. Eventually, earnings confirmation not only shields lenders from potential defaults yet additionally assists consumers evaluate their capability to repay, promoting liable loaning practices. Therefore, meeting earnings verification requirements is crucial for safeguarding a cash advance.Earnings Confirmation Refine

Prior to a cash advance can be accepted, lenders generally need a revenue confirmation process to assure the applicant's ability to pay back the finance. This procedure often entails the submission of different papers that show a constant income source. Generally accepted types of earnings confirmation consist of recent pay stubs, bank declarations, or tax returns.Lenders may additionally require the applicant to supply proof of employment, such as a letter from a company verifying task condition and income. This info assists loan providers examine the candidate's monetary stability and repayment capacity.

Understanding Financing Amounts and Terms

Recognizing funding amounts and terms is essential for customers contemplating payday advance loan. These car loans normally have specific limitations on the quantities that can be borrowed, alongside clearly defined repayment terms. Furthermore, the influence of rates of interest on the overall payment quantity is a necessary aspect to mirror on.Lending Amount Limits

Car loan amount limits for payday advance can vary significantly based on state policies and individual lender policies. Usually, these limits vary from $100 to $1,000, yet some states enforce stricter caps. For example, specific jurisdictions might enable finances approximately $500, while others could allow loans exceeding $1,000. Lenders examine qualification aspects, including earnings and borrowing history, to determine the details loan amount supplied to a candidate. It is necessary for borrowers to recognize that the quantity they can acquire may be influenced by their financial situation and the lending institution's requirements. Potential borrowers must consult regional laws and specific loan providers to gain a complete understanding of available loan quantities and connected demands. Readily available Payment Terms Explained Payment terms for payday advance loan are a critical aspect that debtors have to think about together with the loan amount. Typically, these fundings are designed to be short-term, with settlement usually expected by the debtor's following payday, usually within two to four weeks. Customers must know that failure to pay back within this duration can result in extra charges or the alternative of surrendering the loan, which frequently sustains even more expenses. Comprehending the image source payment routine is crucial for reliable economic preparation, as it affects the borrower's budget plan and future capital. Furthermore, clearness on settlement terms can help individuals avoid dropping right into a cycle of financial debt, making it imperative find out to review these details before committing to a payday advance loan.Rate Of Interest Effect

While debtors typically concentrate on the amount they need, the rates of interest related to cash advance greatly influence the general price and price of these temporary economic products. Usually, cash advance loans carry high-interest rates compared to typical loans, which can substantially raise the total repayment amount. As an example, a loan of $500 could sustain a rate of interest varying from 15% to 30%, relying on the loan provider and regional guidelines. Debtors must very carefully assess their capacity to pay off these lendings within the temporary payment duration, as failure to do so can lead to additional economic stress. Understanding the effect of interest rates is essential for customers to make educated choices and stay clear of falling under a cycle of debt.Benefits of Cash Advance Loans

Payday advance loan offer a number of benefits that can be useful for people encountering urgent monetary demands. Among the key benefits is the rate of accessibility to funds; borrowers can typically obtain money within a short duration, sometimes also on the exact same day (Cash Loans). This quick turnaround is vital for those managing unanticipated expenditures such as medical bills or vehicle repair servicesIn addition, payday advance loan normally call for minimal paperwork and have less qualification needs contrasted to typical finances. This access makes them an attractive option for individuals with limited debt backgrounds or those that might not certify for traditional funding.

Payday fundings can assist customers handle cash flow concerns by giving prompt alleviation, enabling them to meet financial obligations without delay. Installment Loans. Overall, these lendings work as a hassle-free temporary service for those in need, permitting them to browse with financial emergency situations with greater convenience

Prospective Dangers and Factors To Consider

Payday loans can offer quick financial relief, they likewise come with considerable dangers and considerations that debtors need to very carefully examine. One significant worry is the high-interest prices connected with these financings, which can result in a cycle of financial obligation otherwise handled properly. Borrowers may find themselves unable to settle the loan by the due day, resulting in added costs and passion costs. This can produce a challenging financial scenario, pressing individuals deeper into debt.Another risk is the possible influence on debt ratings. While payday lenders typically do not report to credit rating bureaus, failing to pay back can lead to collections, which will negatively influence credit report. Additionally, consumers could deal with legal repercussions if they back-pedal the financing. As a result, it is essential for people to weigh these risks versus the instant financial alleviation that payday fundings may give, ensuring they completely understand the lasting effects of their borrowing choices.

Tips for Liable Borrowing

When seeking a cash advance, borrowers must focus on responsible borrowing techniques to reduce possible risks. To begin with, people should analyze their financial circumstance, guaranteeing they can repay the funding on time without compromising necessary expenses. Establishing a clear payment strategy is vital; customers must compute the complete price of the finance, consisting of interest and fees, prior to devoting.In addition, it's advisable to limit borrowing to required amounts, staying clear of the lure to secure bigger financings than needed. Debtors need to look into lenders thoroughly, searching for credible establishments that offer clear terms and equalities.

Finally, preserving open interaction with the lending institution can be valuable in case of unforeseen circumstances, permitting potential adjustments in repayment terms. By adhering to these concepts, customers can navigate the payday advance landscape extra properly, lessening the risk of falling under a cycle of financial debt

Often Asked Questions

Can I Make An Application For a Cash Advance With Bad Credit Rating?

Yes, individuals with negative credit report can obtain a cash advance financing. Numerous loan providers do not concentrate on credit report scores, read the article focusing on earnings confirmation rather, which opens up opportunities for those dealing with monetary difficulties regardless of their credit report.Exactly How Promptly Can I Obtain Funds After Approval?

Funds are commonly paid out within one organization day after approval, although some loan providers might provide same-day funding. Timeliness often depends on the loan provider's plans and the applicant's financial institution handling times.Are There Any Concealed Costs With Payday Loans?

Yes, payday advance loans typically feature covert costs, such as processing fees or fines for late repayment. Consumers ought to very carefully read problems and terms to avoid unexpected expenses that might arise during the financing period.Can I Settle a Payday Advance Early Without Penalties?

Yes, several payday advances enable debtors to pay off the finance early without sustaining penalties. Nevertheless, it's recommended for individuals to evaluate their certain funding arrangement to verify the conditions and terms relating to very early settlement.What Occurs if I Can Not Repay My Payday Advance Loan in a timely manner?

If a debtor can not repay a cash advance in a timely manner, they might sustain late charges, face collection efforts, and possibly damage their credit rating. It's important to communicate with the loan provider to explore alternatives.Before a cash advance finance can be authorized, loan providers generally need a revenue verification procedure to guarantee the applicant's ability to settle the car loan. Understanding funding quantities and terms is important for customers pondering cash advance finances. Loan quantity limitations for payday car loans can differ substantially based on state regulations and individual lender policies. Payment terms for payday financings are a vital facet that debtors have to take into consideration along with the car loan amount. Yes, several payday lendings enable debtors to pay off the lending early without incurring penalties.

Report this wiki page